How to Diagnose a Drop in Leads for SaaS Before Revenue Is Impacted

Most SaaS teams realize something is wrong only when revenue starts dipping. By then, the damage is already done. The common problem is that many SaaS companies focus too heavily on closed deals instead of monitoring early pipeline signals. Here, you’ll learn how to diagnose a drop in leads for SaaS before revenue is affected.

Before we talk about how to run meta Ads for hotel industry, let’s know why Meta platform is crucial to get your hotels book?🤔

A drop in demo requests, trial signups, or inbound inquiries is often the first warning sign. These early lead indicators usually point to deeper issues in content performance, channel mix, messaging, or audience targeting. Ignoring them can result in slower pipeline velocity, lower conversion rates, and eventual churn.

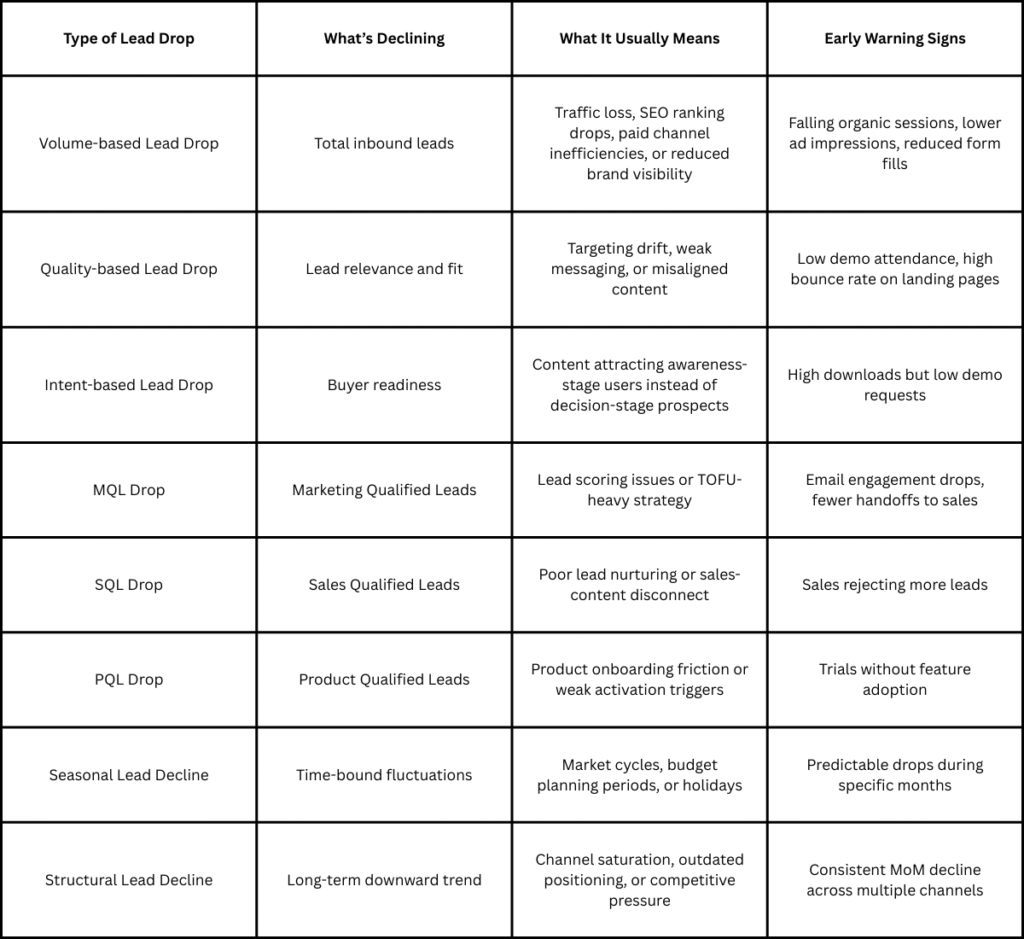

Understand What Lead Drop Actually Means in SaaS

A lead drop in SaaS is not always about fewer leads. In many cases, volume stays stable while lead quality, intent, or readiness to buy declines. Before jumping to conclusions, SaaS teams must identify which type of lead drop is happening and where it is occurring in the funnel.

If your content is generating traffic but not trust, thought leadership could be the missing link in your SaaS lead strategy.

Why This Distinction Matters

Not all lead drops require the same fix. A seasonal decline may only need short-term optimization, while a structural decline signals deeper issues in lead generation, content strategy, channel mix, or positioning. Correctly diagnosing the type of lead drop allows SaaS teams to respond faster, strengthen lead generation performance, and prevent pipeline issues from turning into revenue loss.

Here’s How To Do Quick Self-Check First

Before deep analysis, run this quick self-check to understand what is actually dropping in your SaaS funnel.

- Demo requests vs newsletter signups – If demo requests are down, the issue is usually high-intent traffic or messaging. If only newsletter signups are declining, the problem often sits at the top of the funnel or with lead magnets.

- Conversion speed vs lead drop-off- Leads converting slower point to weak nurturing, unclear value proposition, or longer buying cycles. Leads disappearing early suggest targeting or intent mismatch.

This simple check helps you quickly identify whether the lead drop is about volume, intent, or funnel friction before it starts impacting revenue.

Content Signals That Predict a Lead Drop Early

Content performance is usually the first system to break when a SaaS lead drop is coming. If you know how to diagnose a drop in leads for SaaS, content data gives you the earliest warning signs.

Early content signals to watch:

- Ranking drops on high-intent pages like pricing, comparison, and demo pages often reduce qualified leads first.

- Declining clicks with stable impressions indicate messaging or title misalignment, not visibility issues.

- Content mismatch with buyer stage happens when blogs attract awareness traffic but fail to support decision making.

Want to ensure your content drives consistent qualified leads and helps you diagnose drops earlier? See our step-by-step guide on creating an editorial calendar for SaaS content marketing.

How to Diagnose a Drop in Leads for SaaS Step-by-Step

When lead flow slows, SaaS teams need clarity, not assumptions. This step-by-step approach helps you diagnose a drop in leads for SaaS by isolating the exact point where demand, intent, or conversion breaks.

Step 1: Audit Lead Source Performance First

Before fixing anything, identify where the decline started.

Identify which channels declined first

A lead drop rarely happens everywhere at once. One channel usually weakens first and pulls the rest of the funnel down.

Compare the last 30–60–90 days by source

Looking at multiple time windows shows whether the decline is seasonal, sudden, or structural.

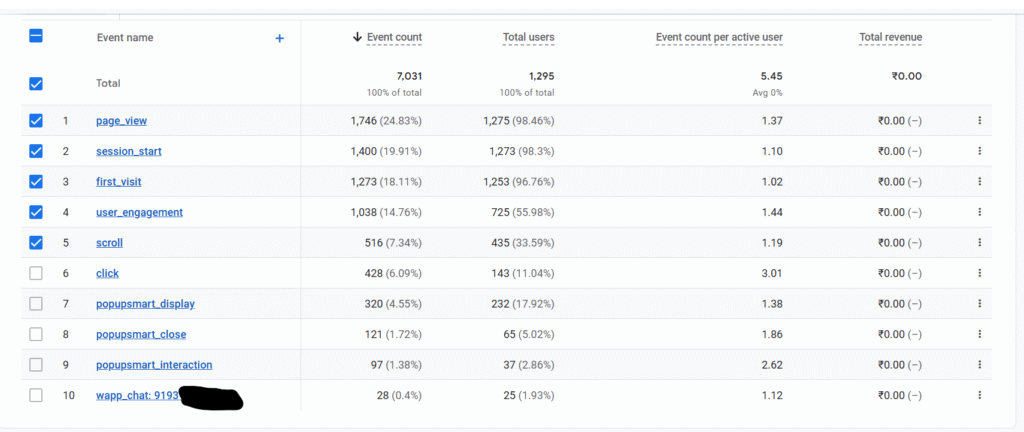

For example, you can track key events like page_view, session_start, scroll, click, demo-related interactions, and chat events across the last 30–60–90 days. If traffic events remain stable but intent-driven actions such as clicks, popup interactions, or chat initiations decline, it clearly shows how to diagnose a drop in leads for SaaS before revenue is impacted.

Spot “silent” channel drop-offs

Some channels keep sending traffic but stop converting, making the lead drop harder to detect early.

Step 2: Evaluate Your Most Effective SaaS Lead Channels

Not every channel that brings traffic supports your revenue.

- Organic search – Organic leads decline when rankings drop on high-intent pages, not necessarily when overall traffic falls.

- Paid search – Paid campaigns often maintain volume while quality drops due to broader targeting or rising CPCs.

- Content-led inbound – Blogs can generate traffic but fail to convert if content no longer matches buyer intent.

- Review platforms – If reviews slow or visibility drops, late-stage buyers may choose competitors instead.

- Partnerships and referrals – A reduction here often signals weakened positioning or reduced brand trust.

These are typically the most effective marketing channels for generating leads in SaaS when optimized correctly.

Traffic Channels vs Revenue Channels

High engagement does not always equal growth.

- Organic content blogs – They attract awareness traffic but often lack decision-stage intent.

- Paid awareness campaigns – These boost visibility but rarely convert without strong BOFU support.

- Social and community traffic – Useful for brand trust, but conversions are usually delayed.

- Why these channels underperform on revenue – They attract low-intent visitors who are not ready to buy.

Why Volume Channels Are Not Always Revenue Channels

Many SaaS teams misread engagement signals.

- Low-intent vs high-intent traffic – Traffic volume can increase faster than buyer readiness, resulting in more visitors but fewer qualified leads.

- Education-stage vs decision-stage visitors – Educational content builds awareness and trust, but it does not immediately drive demos or sales conversations.

- Confusing engagement with pipeline growth – Likes, clicks, and time on page look positive, but they do not guarantee SQLs, opportunities, or revenue.

Funnel & Conversion Diagnostics (Where Leads Leak)

If traffic is stable but leads are declining, the problem is usually inside the funnel. This is a key step in how to diagnose a drop in leads for SaaS before revenue is impacted. Small conversion issues often create big lead losses.

Check these first:

- Landing page friction: Slow speed, unclear messaging, or poor mobile experience reduces conversions.

- CTA visibility and relevance: CTAs must match visitor intent at each stage.

- Form length and trust signals: Long forms and weak social proof lower completion rates.

Conversion insights to track:

- Normal fluctuations happen, but a consistent drop signals risk.

- CRO fixes often recover leads faster than ads by optimizing existing traffic.

- Align improvements with how to set marketing goals for B2B SaaS revenue and content marketing strategies for quick leads in SaaS across the most effective marketing channels for generating leads in SaaS.

Best Channels For Qualified Leads In SaaS Marketing

For your SaaS company, qualified leads can come from intent-aligned content, like:

- Product-led content – Feature explanations and workflows attract users who are actively evaluating solutions.

- Use cases – They help buyers visualize real outcomes and self-qualify before booking demos.

- Feature deep dives – These appeal to technical and decision-ready users comparing options.

- Problem–solution content tied to the product – This bridges pain awareness with clear product relevance.

- Bottom-of-funnel SEO – High-intent keywords capture users who are ready to convert.

- Why BOFU pages outperform generic blogs – They align directly with decision-stage search behavior and buying intent.

These are the best channels for qualified leads in SaaS marketing.

Quick wins only work when content matches current buyer behavior. Staying ahead of SaaS content trends ensures your BOFU and demand content stays conversion-ready.

How to Measure SaaS Marketing ROI Before Leads and Revenue Drop

Measuring ROI early can help you prevent pipeline damage instead of reacting late. Here’s how you can do it:

What To Track First:

- Lead quality vs lead quantity: More leads mean nothing if fewer convert to SQLs or demos.

- Attribution across channels: Identify which channels influence conversions, not just traffic.

- Cost per qualified lead vs cost per click: CPC can look efficient while CPL quietly worsens.

Early ROI red flags:

- Rising CAC without corresponding lead growth.

- More content published but fewer demo requests.

- Increased paid spend with a flat or shrinking pipeline.

SaaS-specific signals teams often miss:

- Product messaging drift from core ICP pain points.

- Content and ads attract the wrong audience.

- Competitors winning comparison keywords.

- AI-driven search answers reducing organic clicks.

Catching these signals early protects revenue and supports smarter content marketing strategies for quick leads in SaaS across the right channels.

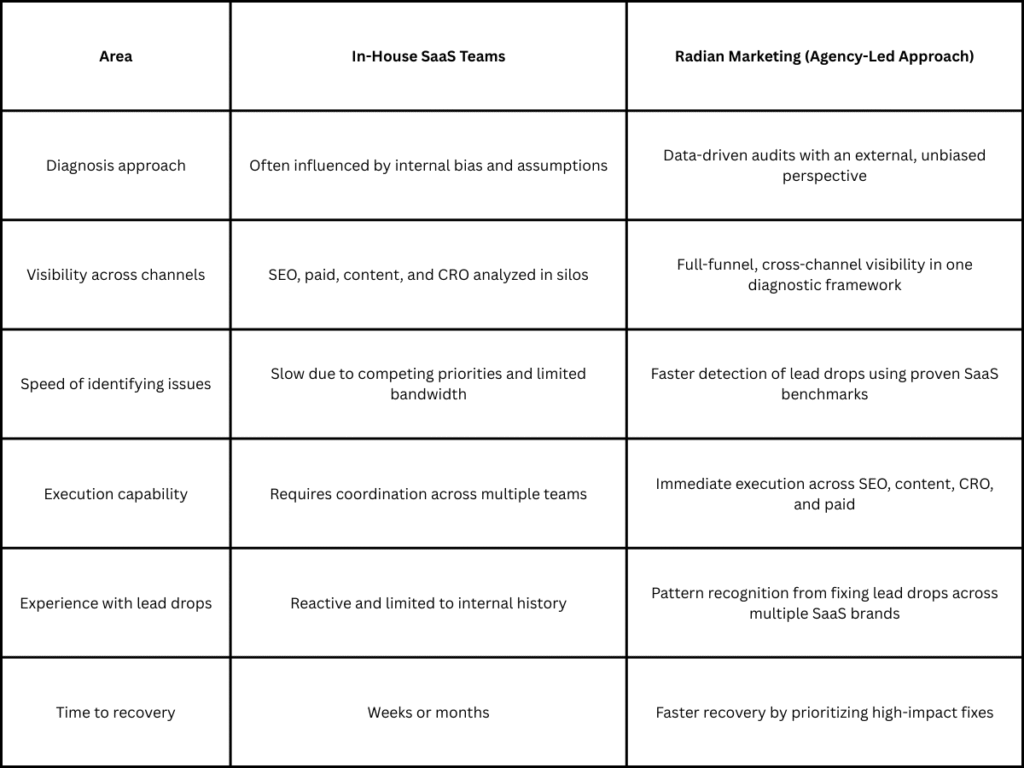

How Agencies Fix Lead Drops Faster Than In-House Teams

SaaS lead drops often need an external perspective to be diagnosed quickly. Internal teams can miss early signals due to familiarity and assumptions, which slows down how to diagnose a drop in leads for SaaS.

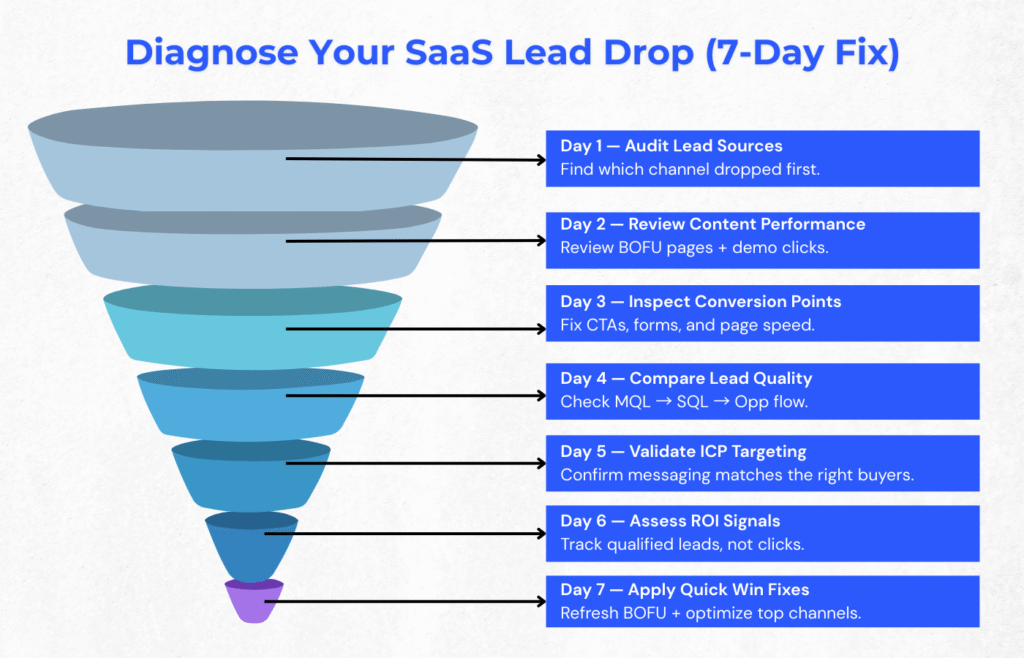

Quick Action Checklist: Diagnose Your SaaS Lead Drop in 7 Days

Use this structured 7-day plan to diagnose a drop in leads for SaaS early and realign execution with marketing goals:

Day 1: Audit lead sources

Start by reviewing all inbound channels such as organic search, paid, referrals, and reviews. Compare performance across the last 30–60–90 days to identify which source declined first. This helps isolate whether the issue is channel-specific or funnel-wide.

Day 2: Review content performance

Analyze high-intent pages, BOFU blogs, use cases, and comparison pages. Look for drops in rankings, clicks, or demo conversions. Content is often the first indicator when learning how to diagnose a drop in leads for SaaS.

Day 3: Check conversion points

Inspect landing pages, CTAs, forms, and page speed. Even small friction like unclear CTAs or longer forms can reduce conversions without impacting traffic.

Day 4: Compare lead quality

Evaluate MQL to SQL conversion rates and demo-to-opportunity ratios. A decline here signals intent issues, not just volume problems.

Day 5: Validate ICP alignment

Review whether your content and ads still target the correct industry, role, and pain points. ICP drift often causes silent lead loss over time.

Day 6: Assess ROI metrics

Move beyond clicks and impressions. Measure cost per qualified lead and understand how to measure ROI of SaaS marketing agency services tied to pipeline impact.

Day 7: Prioritize quick-win fixes

Focus on CRO improvements, BOFU content updates, and channel optimizations that can restore leads quickly without increasing spend.

Conclusion: It’s Time To Fix the Leak Before ROI Gets Affected

Lead drops in SaaS are predictable, not sudden. They show up in content performance, channel efficiency, and conversion behavior long before revenue declines. Teams that understand how to diagnose a drop in leads for SaaS early rely on data-driven diagnostics instead of reactive fixes.

SaaS growth depends on identifying channel and content gaps before pipeline health weakens. Acting early protects revenue, improves lead quality, and keeps acquisition costs under control. The strongest teams focus on intent, conversion, and ROI, not just traffic volume.

If you want to diagnose issues faster and fix what actually impacts revenue, work with a SaaS marketing agency that measures what matters. With a strong focus on SaaS SEO, Radian Marketing helps SaaS brands diagnose a drop in leads for SaaS, uncover hidden lead leaks, and stabilize growth before revenue feels the pain.

Bhaskar Gupta

Bhaskar Gupta is a passionate digital marketing practitioner and has keen interest in SEO, Social Media Strategy, Business Digital growth, and Performance marketing. He has worked with multiple brands in different industries across India and abroad. In 2022, he has set up his own digital growth and marketing agency named Radian Marketing.