Key Takeaways:

1. Facebook Ads help financial advisors build brand trust and generate qualified leads.

2. Targeted ad campaigns using interests, behaviors, and demographics are essential for reaching the right audience.

3. Educational content (like financial tips or webinar invites) increases engagement and positions you as an expert.

4. Lead forms and retargeting boost conversions by capturing and nurturing warm prospects.

5. Consistent testing and optimization are key to improving ad performance and ROI over time.

Some of you might be thinking, “Does Facebook advertising for financial advisory business work?”

Well, I’m not gonna say much. You’ve got to see the power of Facebook ads and what you can achieve here to meet your goals.

Just keep reading.

Did you know that Facebook advertising for financial advisors is one of the most effective ways for you to promote your services?

Let me show you the stats first.

Facebook boasts a whopping 2.74 billion monthly active users, with 1.82 million folks jumping on daily. That’s a massive pool of potential connections and clients right there!

So, if you’re a financial advisor wanting to attract high-net-worth clients, one source reports that 74% of Facebook users are high-income earners.

If you’ve been eager to elevate your marketing efforts into the realm of Facebook ads for financial advisors, this detailed Financial Consultant Facebook Ads guide is all you need.

Let’s get started.

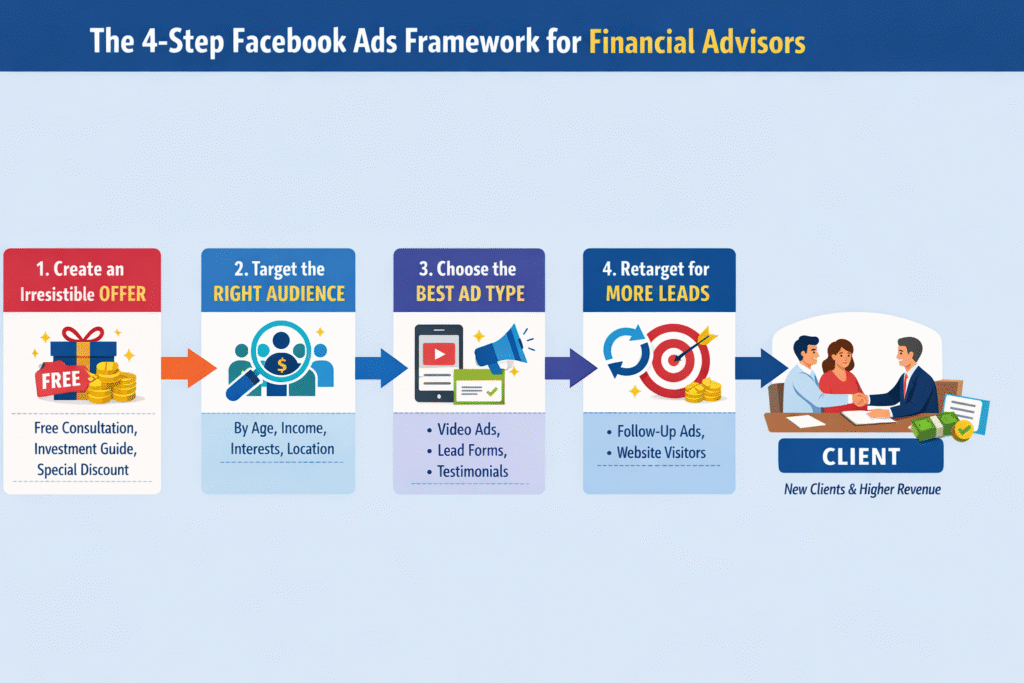

How to Run Facebook Ads for Financial Advisors: Step-by-Step Framework

Bring a pen and paper and get ready to take notes as you move forward with the steps of setting up Facebook (and Instagram ads).

STEP 1: CREATE A CAPTIVATING OFFER

Before diving into the world of Facebook ads for financial advisors, let me ask you to think: What makes you stand out in the market? What sets your financial advisory business apart?

These are often overlooked questions in crafting a compelling offer, yet they are key to connecting with potential clients.

Now, back to our journey into setting up Facebook ads for financial consultants. The first step is creating an irresistible offer. Picture it as your golden ticket – the key to unlocking doors and gathering valuable contact information from potential clients.

You need to craft an offer so compelling that your ideal prospects can’t resist taking action without a second thought.

So, what makes an offer so compelling that it drives new leads for your financial planning services?

A compelling offer should meet these criteria:

- Great value

- Low Friction

- Right Prospect

Your offer must give great value to your prospect

It must be of great value to your target audience. Wondering how to do it? No worries, we’ll make it simple for you.

For Meta advertising for financial advisors, a discount on a service that costs a significant amount may be motivating enough. You can also consider offers like a free consultation, educational resources, exclusive insights, and a quick investment guide.

Consider offering a complimentary service when a client purchases another.

For example, you can offer a free consultation on how to manage money, investment guidance (i.e. to say where to invest, how much to invest, etc.), and retirement planning.

Another example could be, that an insurance provider can offer one free month of insurance coverage by purchasing a year of insurance plan. This not only enhances the value for potential clients but also encourages a long-term commitment.

Certainly, offering free consultations or services may incur initial costs, but it’s an investment in building long-term relationships.

From there, you can extend your services, offer additional consultations, and even present comprehensive packages.

What may start as a free service can potentially lead to substantial returns, as clients may choose other paid services or engage you for ongoing consultations.

In the long run, the initial investment can translate into significant revenue and client satisfaction.

Your offer must be of Low Friction

A compelling offer should have to be of low friction, simple, and easy to understand.

Avoid complicated terms and conditions that add friction to your offer. Simplify the process, making it a no-brainer for your prospects to engage.

For instance, If you’re a Facebook marketing financial planner who helps people develop high-growth investment portfolios, then putting your offer for a certain dollar investment will limit your offering to a specific audience and you might lose your potential leads.

This may create friction in your offers. Not everyone may be willing to opt for a family insurance plan, limiting the appeal of the offer.

Keep your financial advisory facebook ads offers straightforward, making it a clear choice for your prospects.

Avoid any barriers that could lead to lower conversion rates and hinder the success of your Facebook advertising campaigns.

Let’s get back to the offer we made. If we had tied the offer of consultation services exclusively to the purchase of a specific amount of health insurance, the Facebook campaign might not have performed well.

Making such a requirement could limit the appeal and effectiveness of the offer….

Clients may start with a smaller commitment, like a simple financial review, and then you can showcase the value of your expertise.

Your offer should attract the Right Prospect

Make sure your offer resonates with the right audience. While offering unrelated freebies might grab attention, it’s crucial to attract potential clients genuinely interest in financial advisory services.

For instance, to engage someone in comprehensive financial planning (your core offering as a financial advisor), you might start by offering a free initial consultation.

Before committing to a full consultation, potential clients may want to gauge your expertise. Offering a simplified service, such as a free financial consultation or educational webinar tailored to your target audience can be more effective than generic giveaways and it becomes a valuable introductory offer.

While making an offer to run financial advisor Facebook ads, the goal should be to initiate meaningful conversations with potential clients, even if it means making a small upfront investment.

STEP 2: FIND THE RIGHT AUDIENCE

Most people believe that finding the right audience is the challenging part, but in the realm of Facebook advertising for financial advisors, it’s surprisingly straightforward.

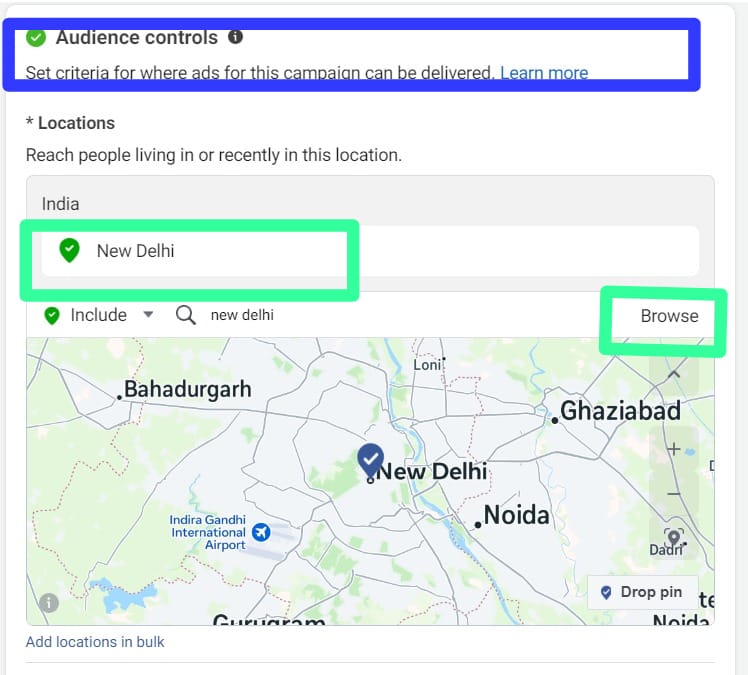

As a financial advisor, your services are likely constrained by geography. You operate within specific regions or perhaps cater to certain cities or states. This geographical limitation makes targeting a breeze.

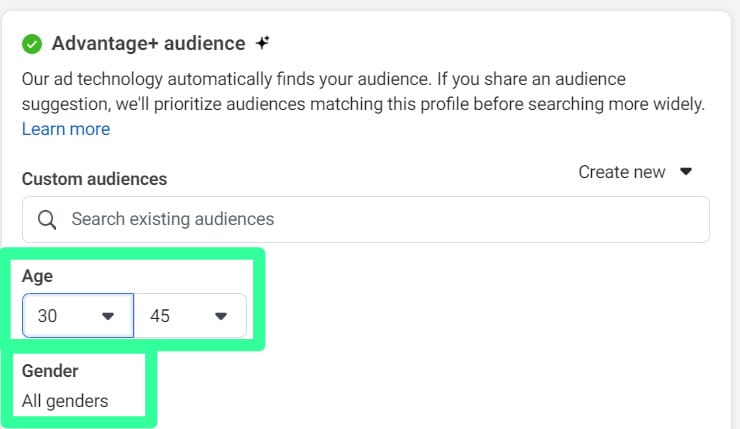

You get to pick who sees your ads! Make it as broad as a group of retirees aged 55-65+ or a group of young adults aged 25-35 with stable jobs or income.

For example, when you want to sell family insurance, aim for an age group like 30-45. That’s because this age group is more likely to have a family and need a health plan for a secure future.

This helps you target potential clients who match what you’re looking for. On Facebook, you have options to make sure your ads reach the right people.

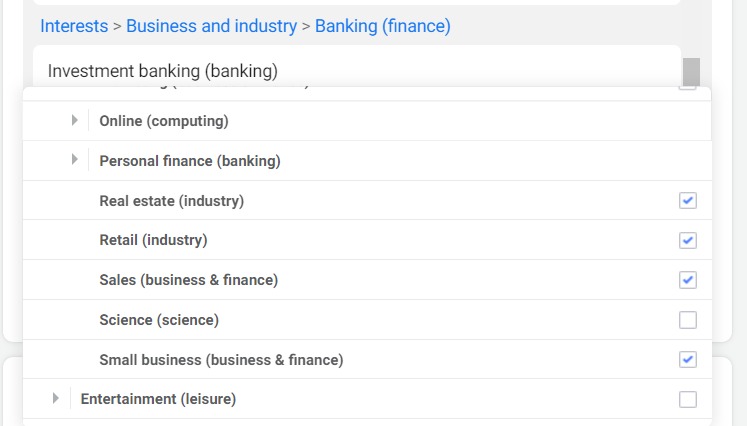

Below could be the targeting options for your Meta Advertising for financial advisors:-

- Interests (i.e. Stock/investing, personal finance, Social Security, etc…)

- Demographics (Age, gender, Status, etc…)

For example, You’re in the business of promoting health insurance, aiming to reach the right audience on Facebook. Well, here’s a golden nugget – consider targeting the age group of 30-45.

Why, you ask?

Because this age group is more likely to have a family and a pressing need for a health plan, to secure a healthy future.

- Income (Household Income- top 10%, top 25%, top 50%). The data given below is US-based.

Facebook Advertising for Financial Advisors: A Targeting Example

Suppose you’re offering Facebook marketing for financial planners in New Delhi. By typing in New Delhi, and selecting New Delhi State, your location targeting is seamlessly configured

For smaller financial planning business, target specific neighborhoods or cities, or enter the relevant zip codes.

If you want to reach individuals within a certain distance from your office, input your address and appropriate mile radius:

Ensure you select “people who live in” to target individuals firmly rooted in your city.

For financial advisors targeting individuals with stable jobs or families, you may consider setting a minimum age (as this demographic typically includes more established individuals) and exploring employment or family status behavior targeting.

This ensures your ads are directed towards those with a stable income or family structure, preventing unnecessary budget waste on individuals who may not align with your target audience.

From here, the next step is crafting a well-designed Facebook ad that effectively communicates your message, transforming viewers into potential leads for your financial advisory business.

STEP 3: Choosing the Right Facebook Campaign Objective (Leads vs Conversions vs Awareness)

For financial advisors, the effectiveness of ad types depends on the goals and preferences of your target audience.

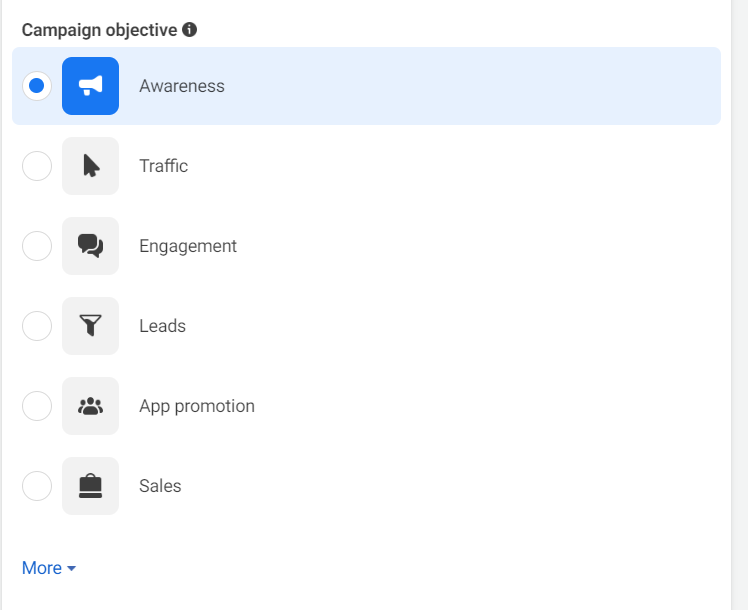

There can be multiple goals you want to achieve while doing Facebook advertising for financial advisors. This can be brand awareness, engagement, or conversion as shown below.

Depending on your Facebook ad goal, the ad can be created.

Here are some ad types that often work well for financial advisors:

Testimonial Ads

Showcasing positive experiences and testimonials from satisfied clients. In these ads, showcase testimonials that resonate with potential clients, demonstrating how your expertise has made a meaningful difference in their financial journeys.

Utilize genuine stories to build credibility, instill confidence, and convey the tangible benefits your financial advisory services bring to individuals and families.

For example, consider creating a carousel post or a video post featuring customer reviews. Share compelling stories about how health insurance or fire insurance provided support during their tough times.

Alternatively, you can highlight how your consultation services have guided individuals in contemplating their financial future, ultimately leading them to invest in retirement plans.

Lead Generation Ads

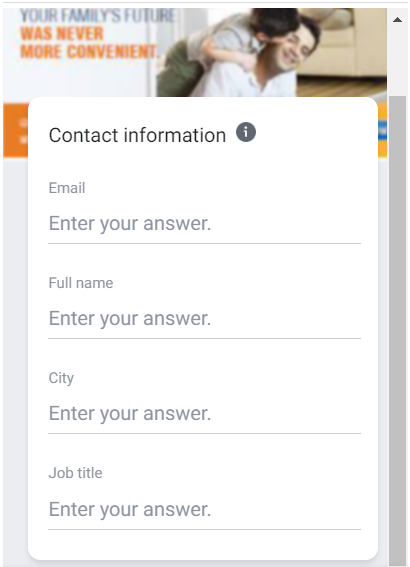

Lead ads are a fantastic option as Facebook ads for financial advisors, especially if your website is outdated. With lead ads, you can efficiently collect contact information directly from the Facebook feed.

In essence, individuals viewing your ad won’t need to leave Facebook. They can simply click a ‘Book a Call’ or ‘Learn More’ button, instantly prompted to provide details such as their name, email, or phone number – whichever is relevant to your offer (keep it low friction!).

One notable advantage of lead ads is the pre-population of certain form fields. Facebook may already have user information like name and email, streamlining the sign-up process.

You can create a lead form like the one below:

Video Ads

These ad types are highly engaging for obvious reasons. Crafting a short video to showcase your expertise, explain financial capabilities, and add a personal touch can set you apart from competitors relying on static image ads.

Your video doesn’t need to be a Hollywood-level production.

Simply use your smartphone’s camera to share insights about the value you provide to clients. As you observe positive results from your Facebook video ads, you can gradually invest in more polished content.

If appearing on camera feels daunting, you can opt for Facebook’s built-in slideshow creator.

Schedule a Quick Call and know how you can get a converting ad for your financial planning consultancy business.

STEP 4 GET BACK TO THE PEOPLE WHO INTERACTED WITH YOUR ADS OR VISITED THE WEBSITE BUT DIDN’T CONVERT!

The final step in Facebook advertising for financial advisors ensures you make the most of your marketing efforts.

Once you’ve started to generate leads with Facebook ads, another great way to get more of these leads to convert into clients is to retarget them outside of Facebook & Instagram.

For example, targeting brand new clients may not be the right direction for your book of business, perhaps you want to connect with your current clients’ heirs and develop specific communication for that purpose.

Even if you’ve diligently followed the initial steps of this Facebook advertising strategy, not everyone who sees your ad will immediately take you up on your offer. This is normal, and the key to increasing conversions is through retargeting.

Retargeting, or showing another ad to those who didn’t take action initially, is crucial. Here’s what you need to do:

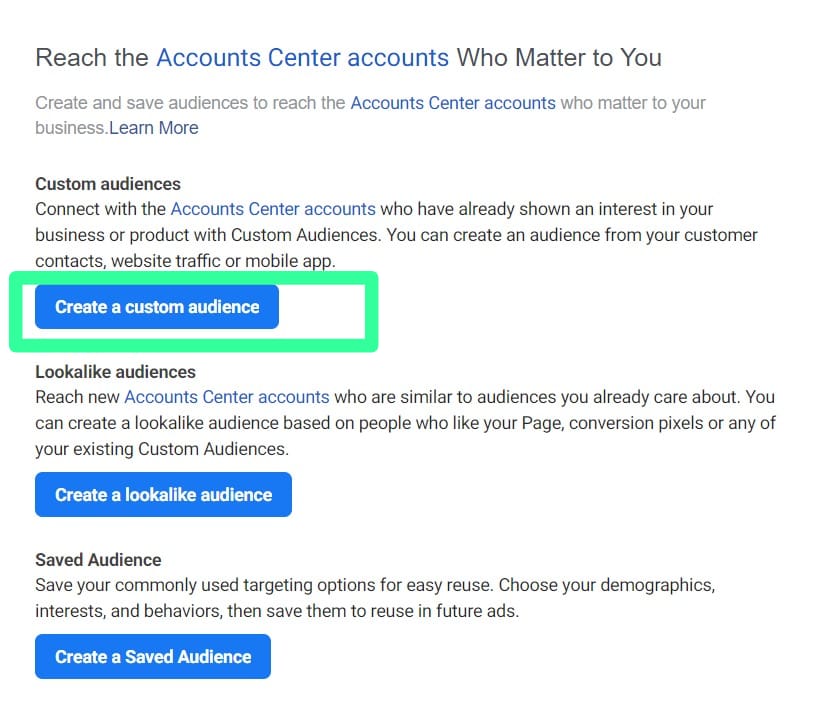

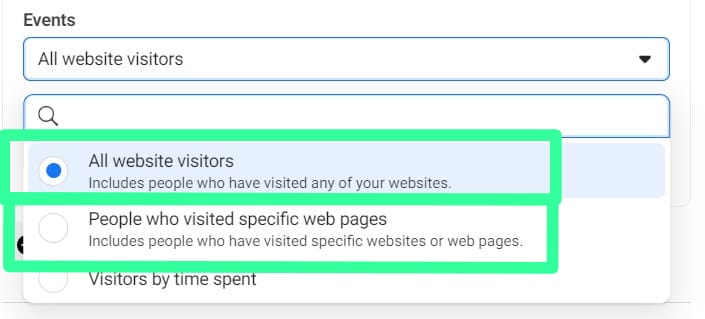

- Set Up Custom Audiences:

- Create a custom audience for those who visited your landing page (where contact information is captured).

- Create another custom audience for those who visited the landing page or thank you page (after submitting their information).

Objective: Show ads to those who visited the landing page but didn’t complete the form.

Tip for Facebook Ads for Financial Planning Business Retargeting:

- When retargeting, use a different ad compared to the initial one.

- Consider using testimonials, videos of satisfied clients, or more promotional messages.

- Since these individuals are already aware of your offer, these ads provide the extra nudge they need to complete the process.

Remember, retargeting helps you re-engage with potential clients who showed interest but didn’t convert initially. It’s a powerful tool to maximize your chances of turning website visitors into new leads for your financial advisory business.

Prerequisite of Doing Facebook Advertising for Financial Advisors

Often, financial planning related services require compliance with the local regulations and guidelines. Depending on the country of your business, make sure your company is under regulation and allowed to promote on digital platforms.

Now, take a quick look what things you require in order to promote your financial planning business-

Create a Facebook Page for the business or organization:

- Ensure it is separate from your personal Facebook account.

- Have more than one Admin for the same FB Page if needed.

Choose a goal for the ad campaign and decide budget:

- Log in to the FB Page and go to business. Facebook, then Ads Manager.

- Options include Awareness, Lead generation, or Conversion.

- Choose a daily budget (average amount per day) or a lifetime budget.

Plan Landing Page/Instant Form Information:

- Decide on the landing page or use FB’s Lead Generation option.

- Create a form with program-specific questions.

- Attach Terms and Conditions/Privacy Policy page in the form and on the landing page.

Check Post/Ad Creative Image Dimensions:

- Verify dimensions before uploading to avoid distortion on newsfeed or stories.

- Use tools like Canva for resizing and downloading.

- Follow Facebook’s image policy to prevent ad rejection.

Just like financial advisors, real estate professionals can benefit from tailored SEO strategies to improve visibility and attract quality local leads

Get Started Transforming Your Facebook Ads For Financial services

Facebook advertising for financial advisors doesn’t have to be complicated, and our 4-step game plan is living proof.

Yes, you can get more advanced than this if you have aggressive growth goals (that’s what our done-for-you financial advisor marketing system is for).

But this strategy is a perfect place to start.

To quickly recap…

Come up with a compelling offer that attracts the right prospect and that’s high value, with low friction.

Follow the simple targeting settings mentioned in this article, and test using the advanced behavioral targeting settings once you feel comfortable.

Choose 1 or 2 ad types that get your prospects to take action.

Leverage custom audiences to retarget people who saw your offer but didn’t take action the first time.

That’s all there is to it, and implementing a Facebook ads strategy like this can transform your financial advisory business!

Want us to handle your Facebook ads for you? Book a 15-minute demo call to learn more about how we can help you get more business from Facebook.

Bhaskar Gupta

Bhaskar Gupta is a passionate digital marketing practitioner and has keen interest in SEO, Social Media Strategy, Business Digital growth, and Performance marketing. He has worked with multiple brands in different industries across India and abroad. In 2022, he has set up his own digital growth and marketing agency named Radian Marketing.